Perplexing New World

Navigating changing World order, Economies & Markets

We had the opportunity to present our views to a select audience last fortnight. Below is a summary of the key ideas we shared, along with the slide deck we used to make sense of the evolving macroeconomic landscape.

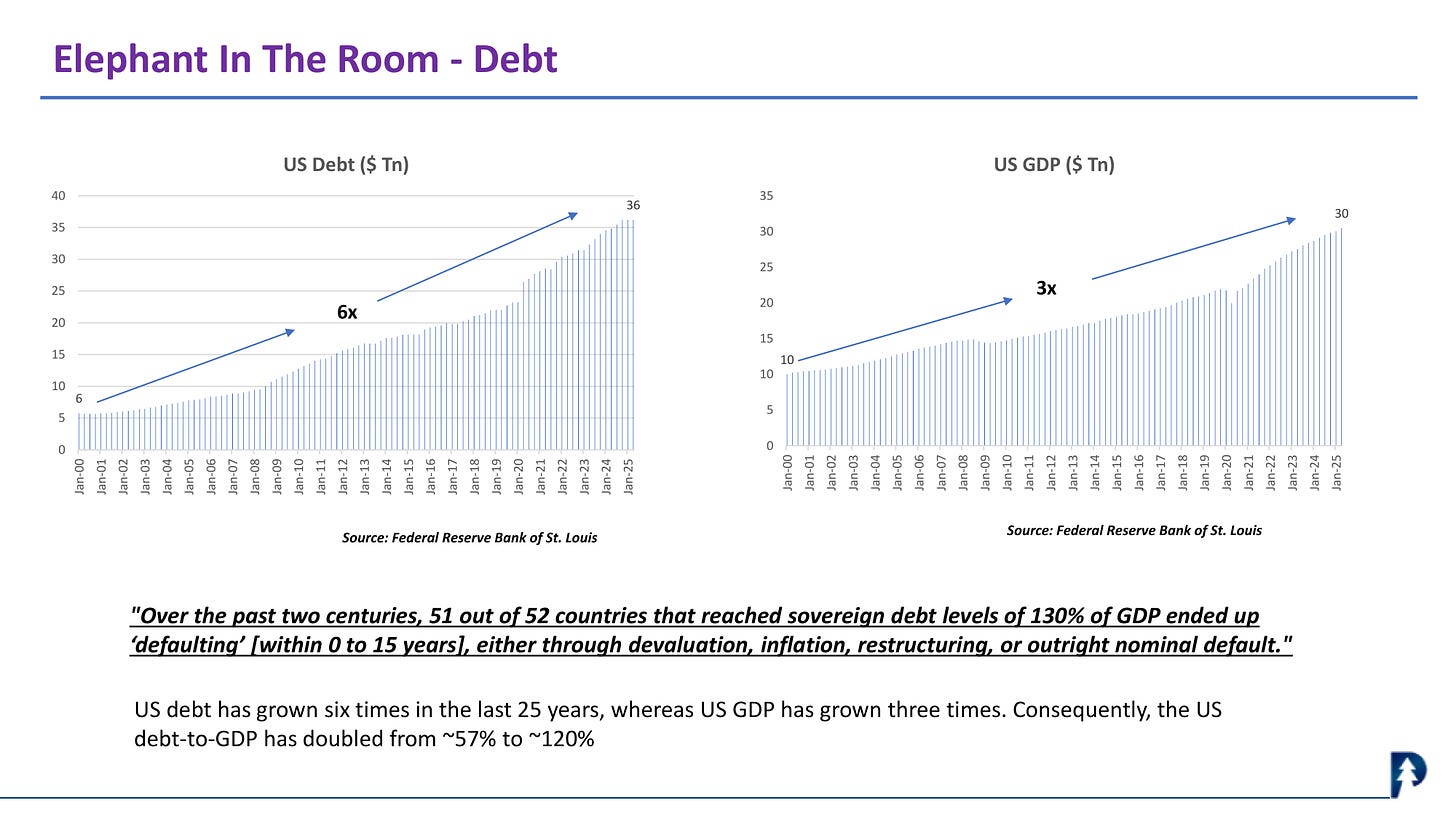

We believe that debt is the greatest strategic constraint for the U.S. at the moment, and the slide illustrates why.

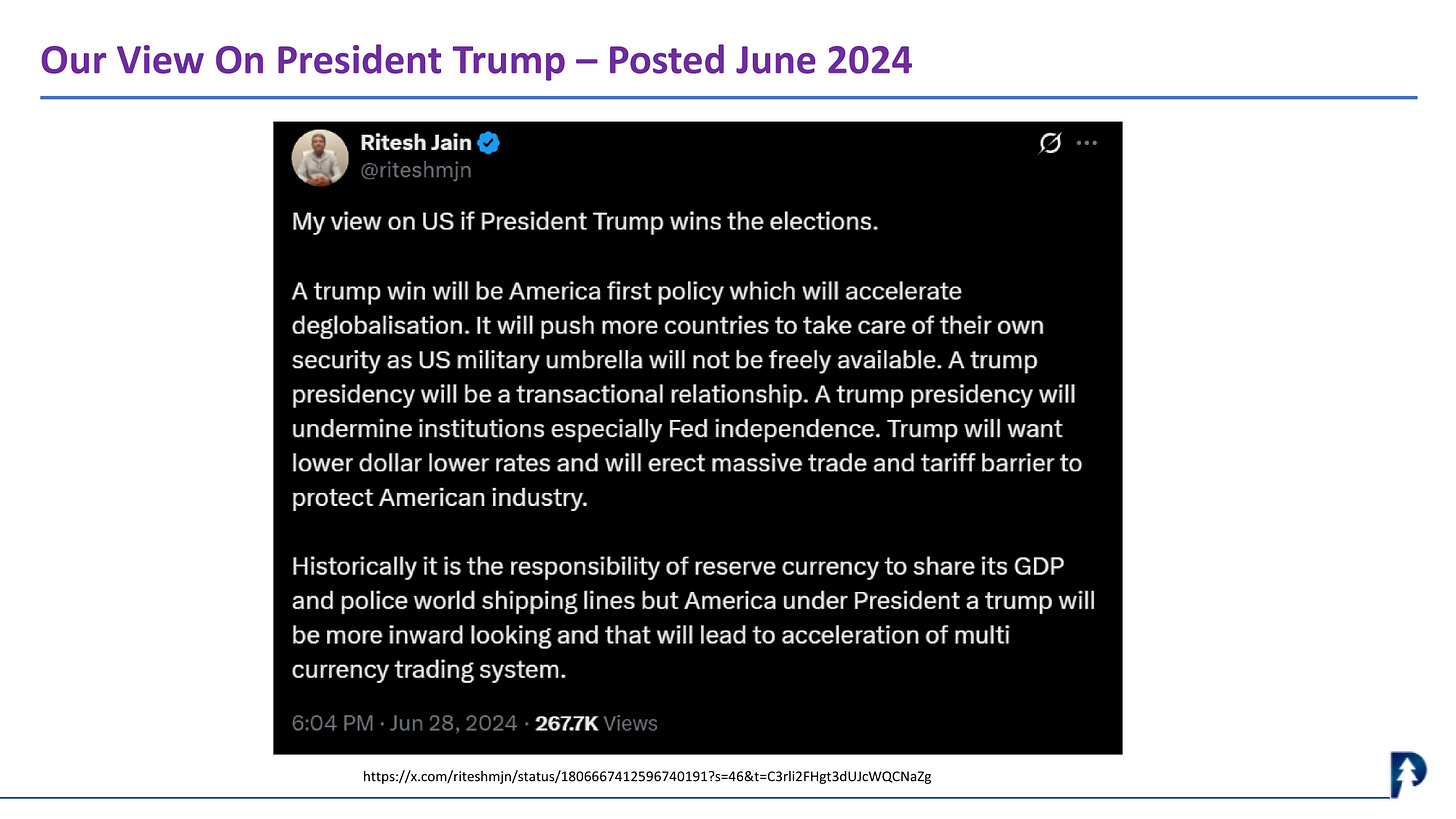

What we are witnessing now with respect to President Trump was evident to us in the second half of 2024.

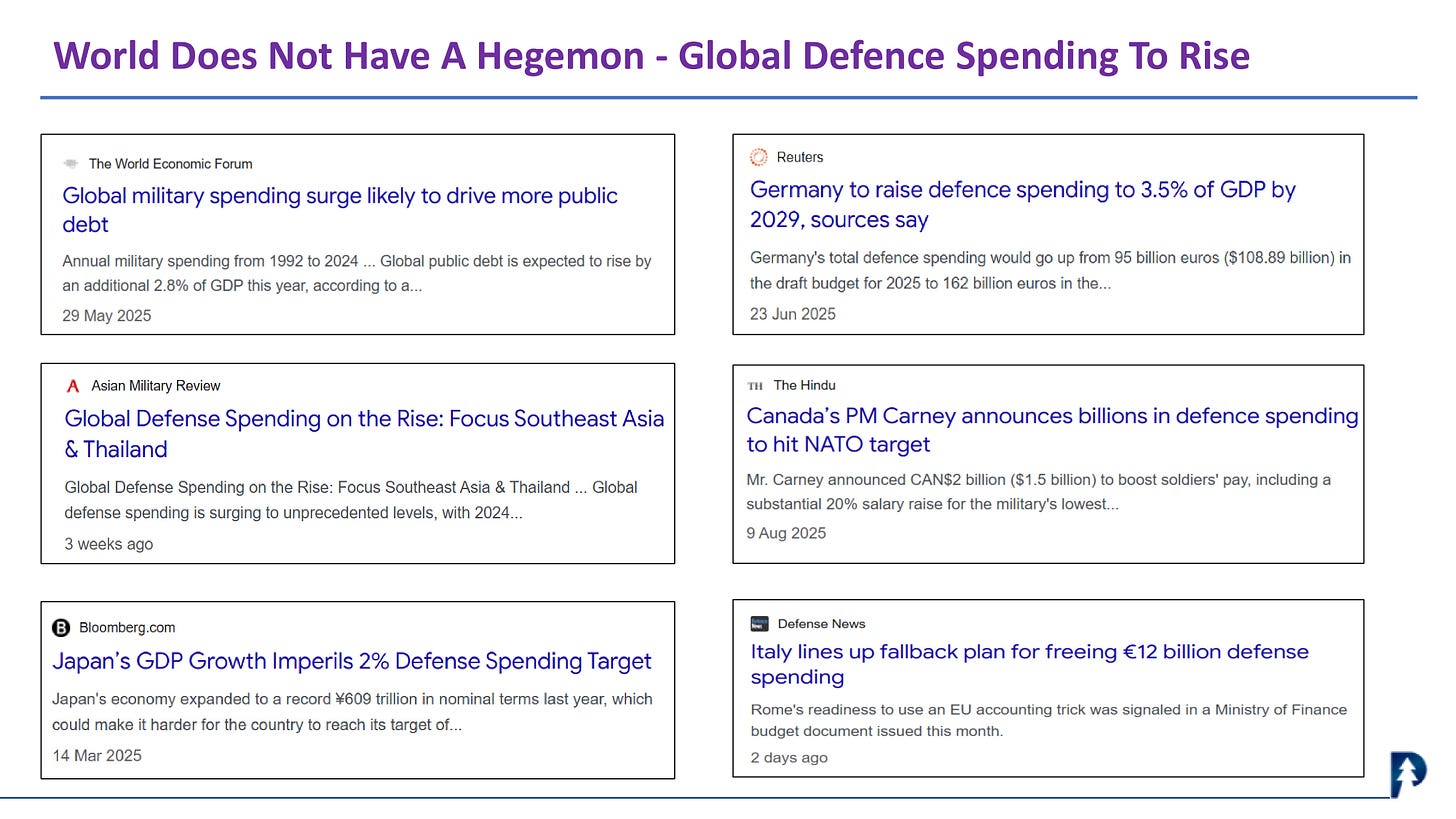

When the classroom monitor steps out, everyone tries to become the classroom monitor.

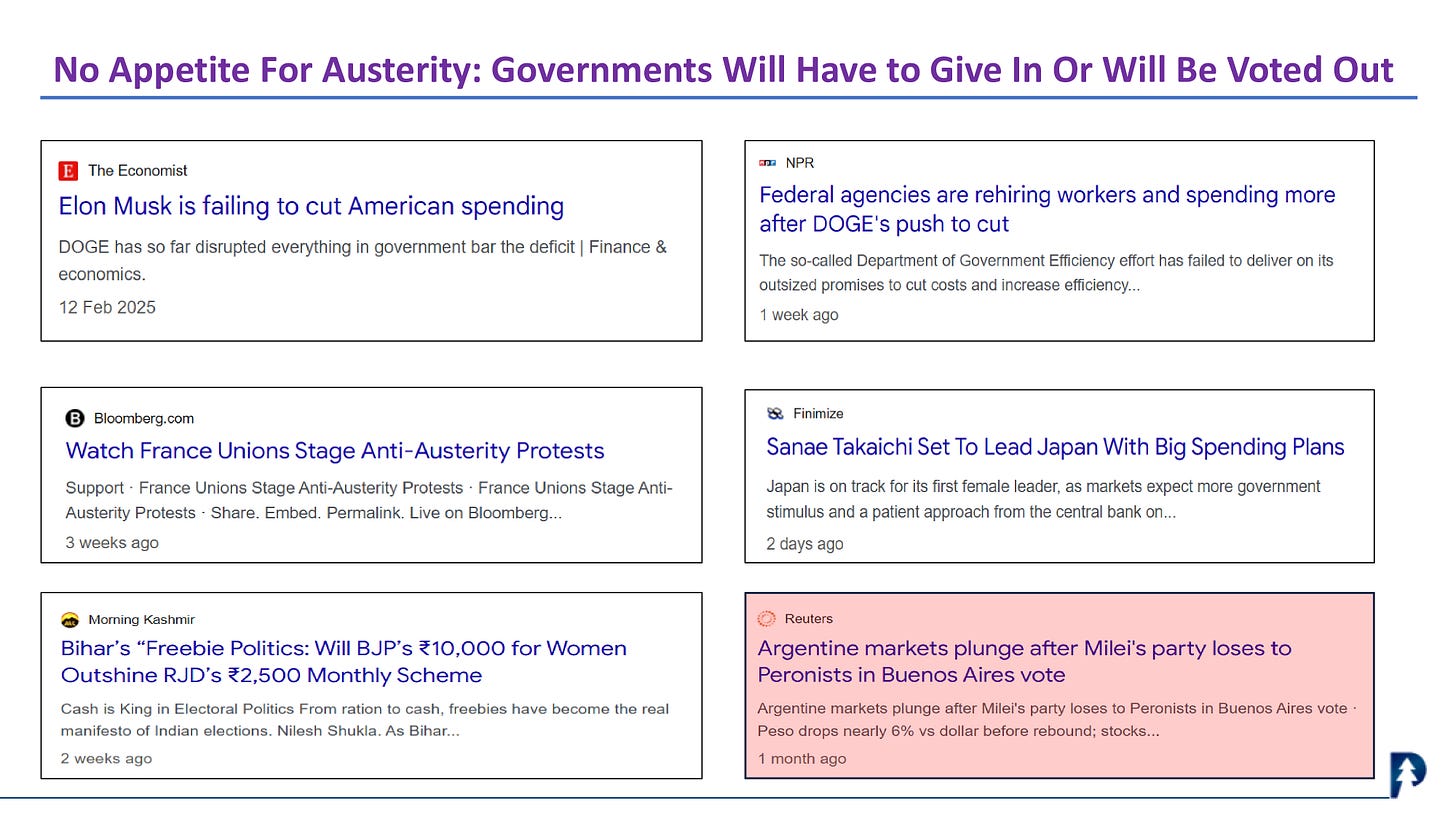

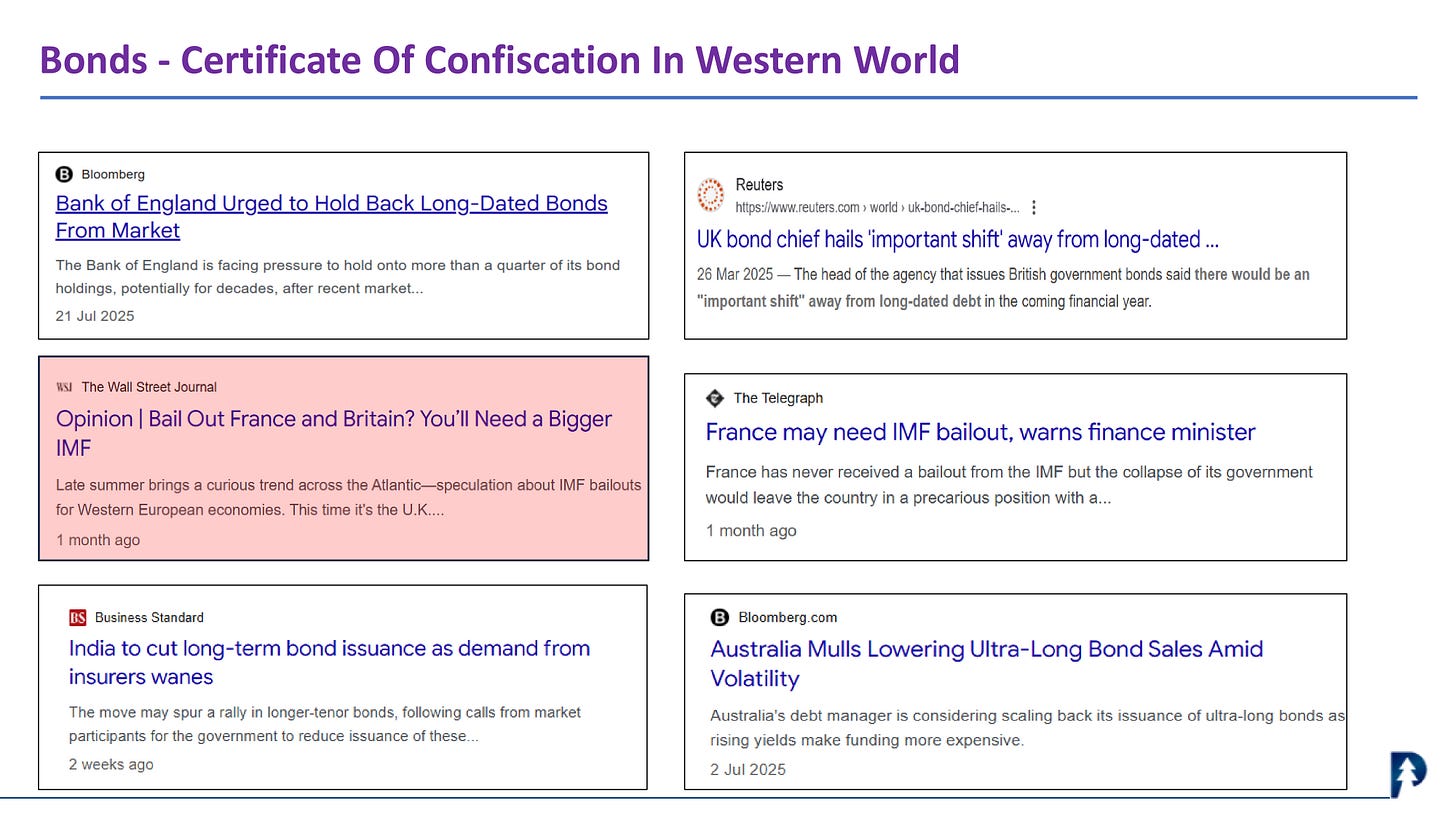

People will not accept austerity; any attempt to impose it will be met with resistance and could even lead to a change in government.

Argentina is a case study for us:

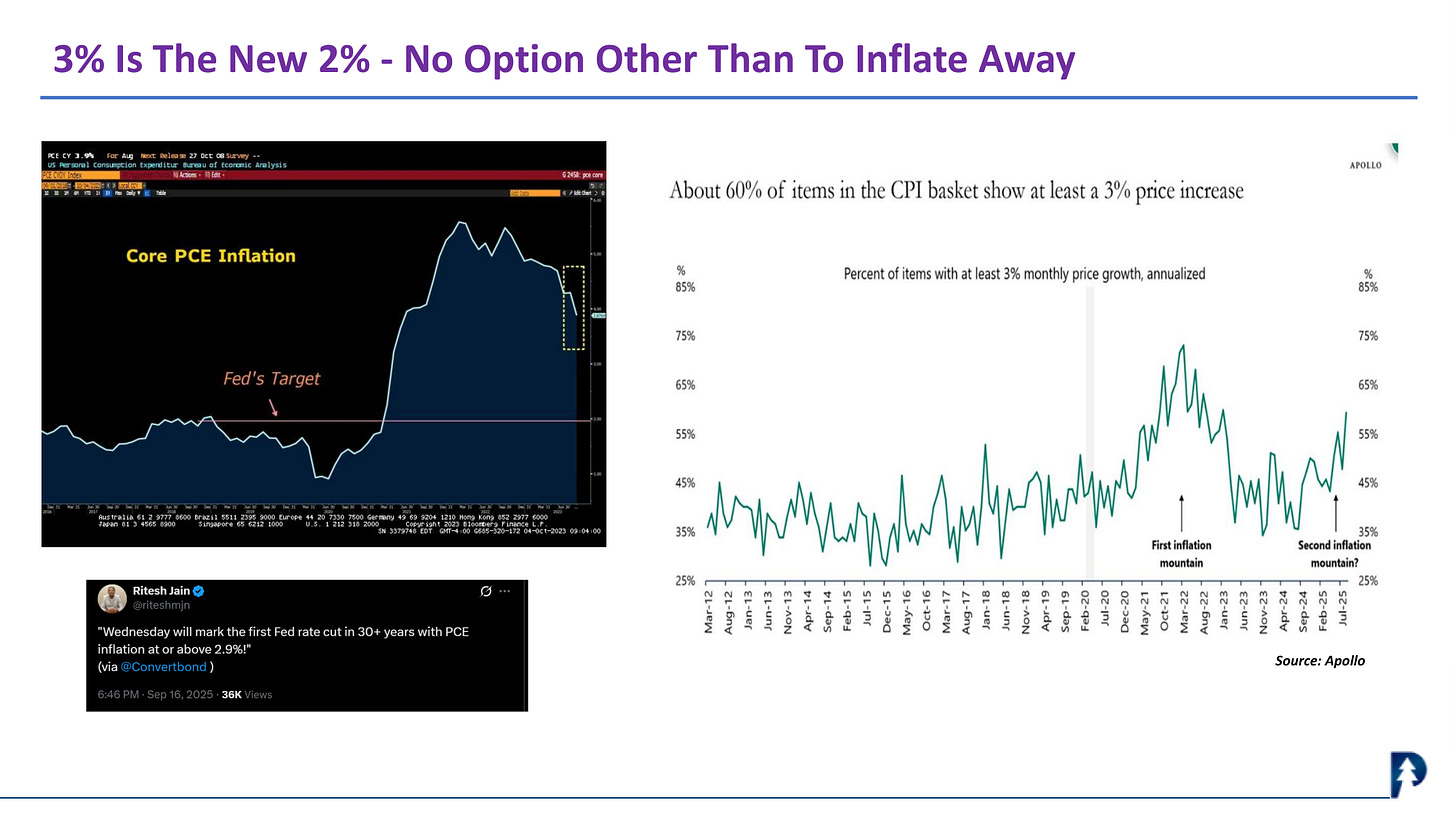

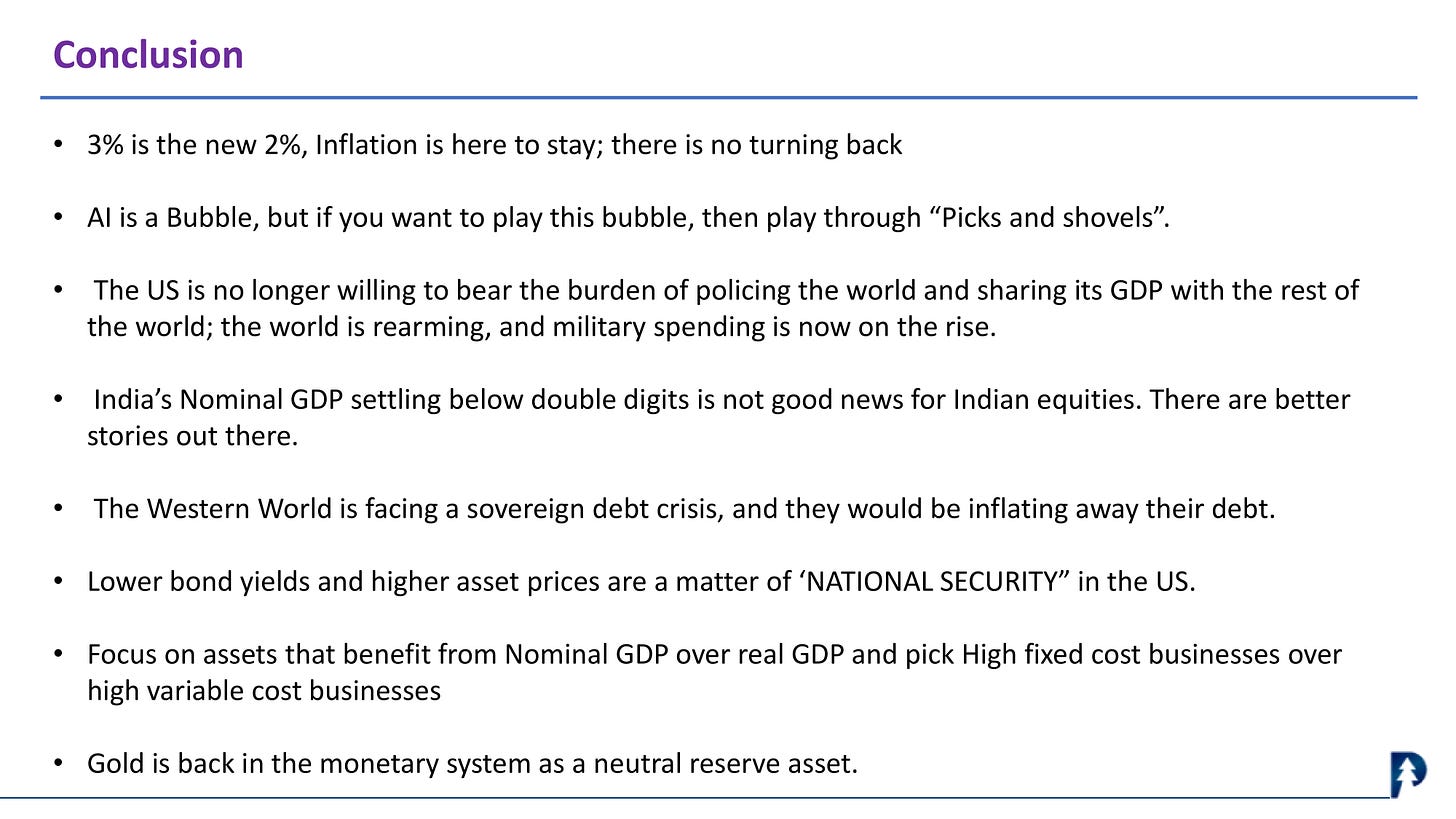

The post-World War II playbook appears to be back in action. The U.S. has quietly transitioned to a higher structural inflation floor.

Bondholders will be left to pay the bill:

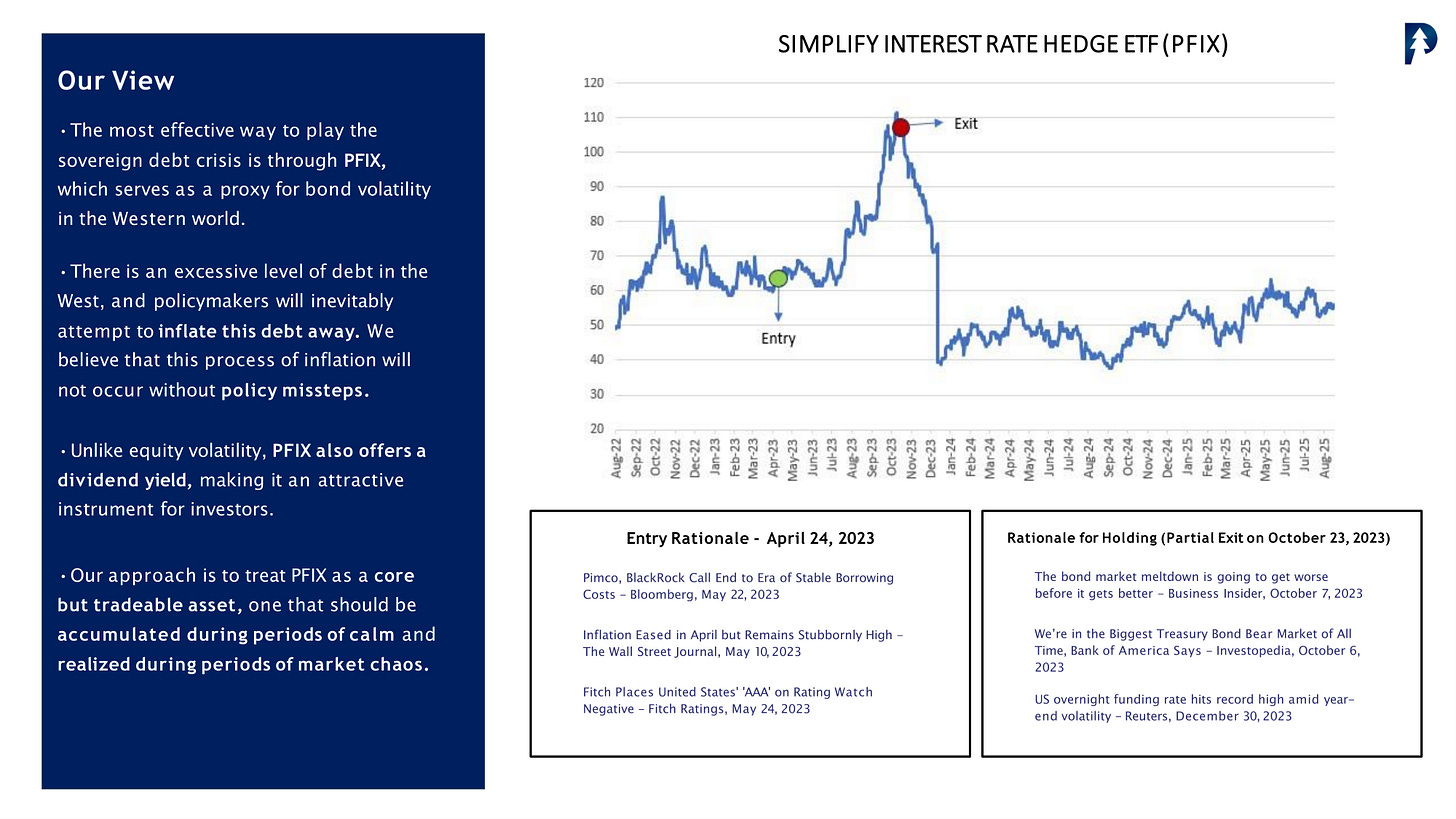

We often say that for every theme under the sun, there’s an ETF (or ETN), and PFIX remains our preferred vehicle to play the debt crisis.

The U.S. pursuit of oil is driven by the belief that no price is too high, no collateral damage too great, and no consequence too grave.

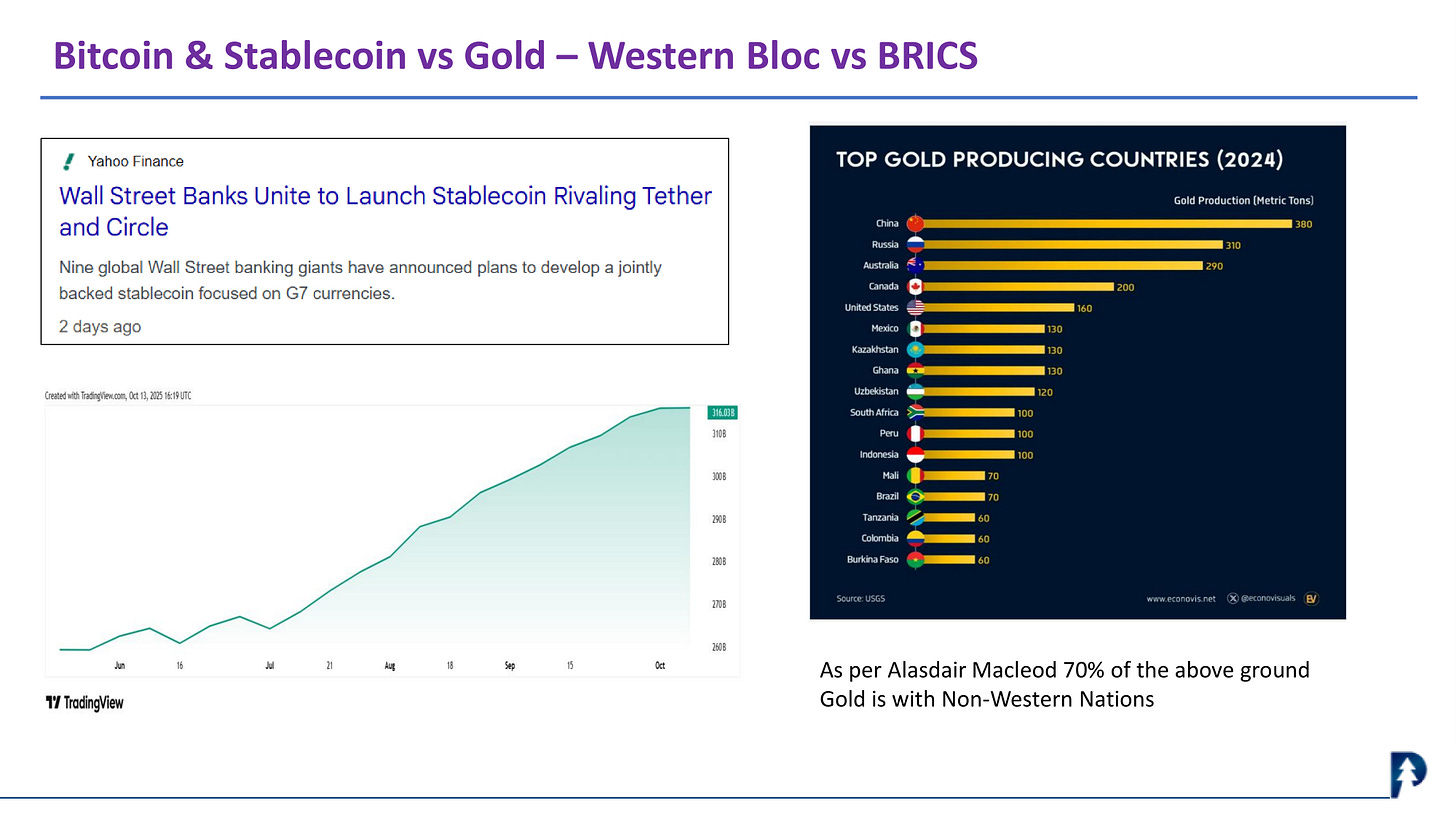

The U.S.-led Western bloc aims to build a financial ecosystem anchored in Bitcoin and stablecoins, largely because gold reserves and mines are concentrated within BRICS nations.

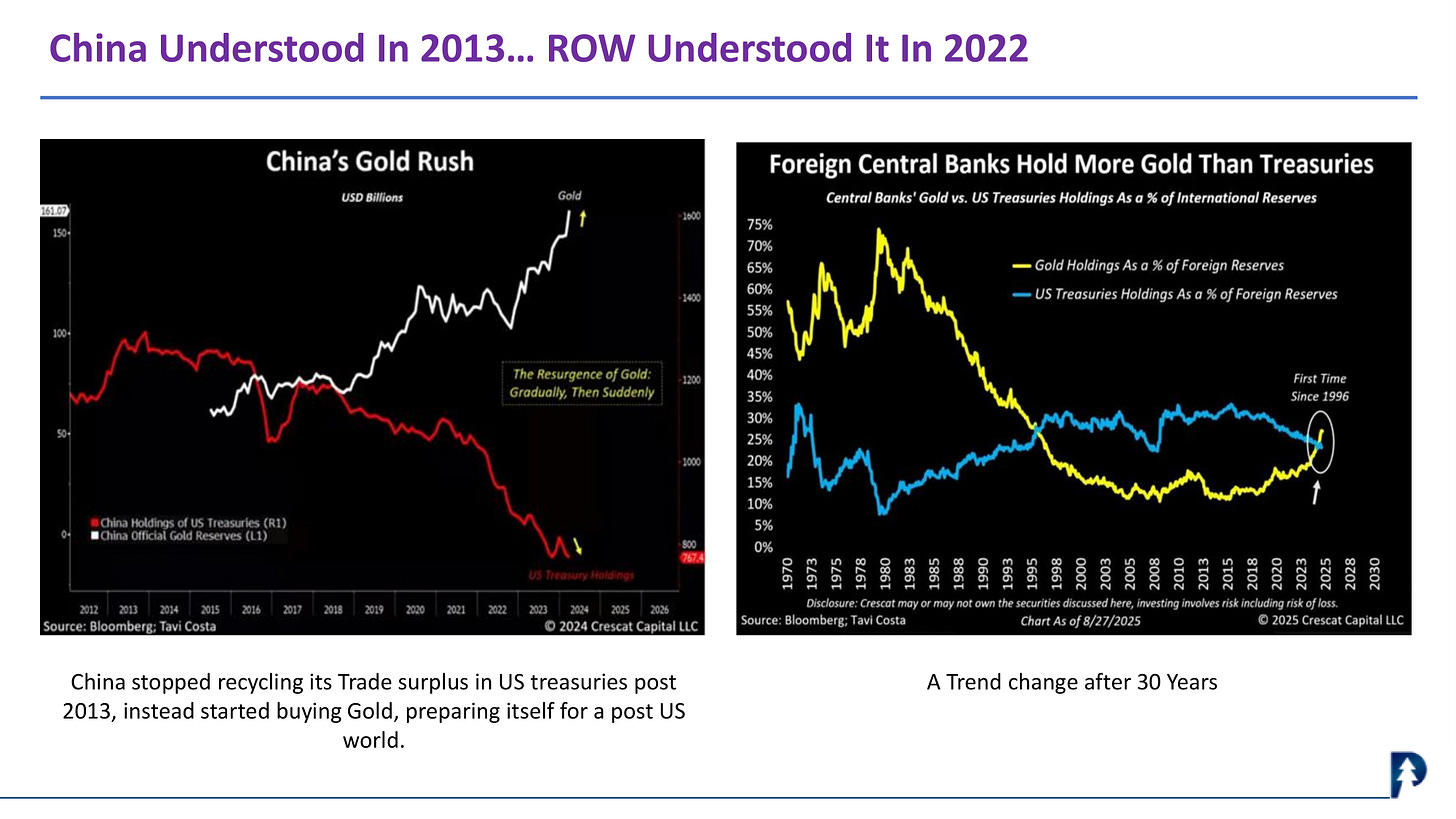

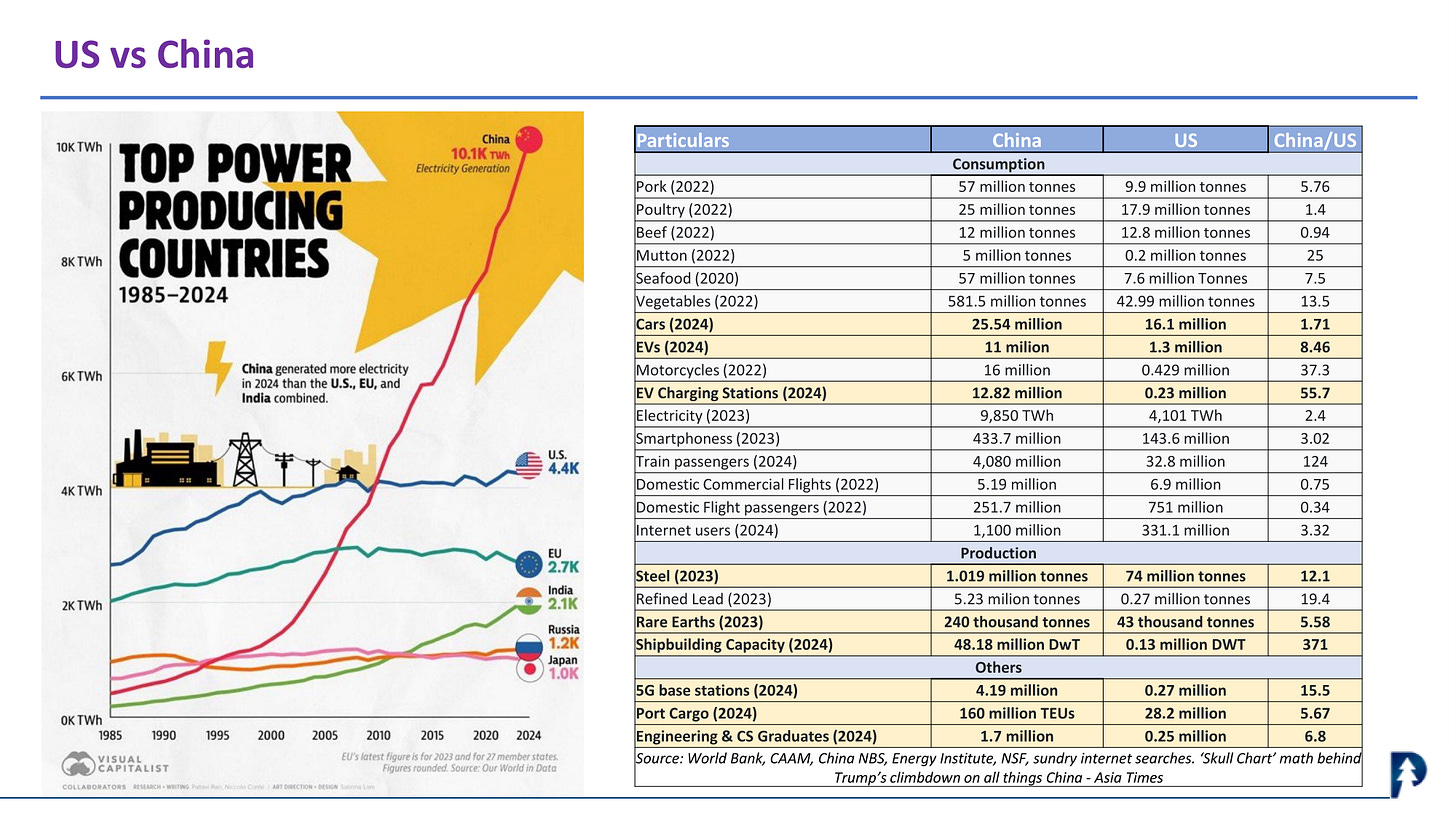

China stopped recycling its surplus into U.S. Treasuries after 2013, preparing for an eventual economic and strategic faceoff with the United States.

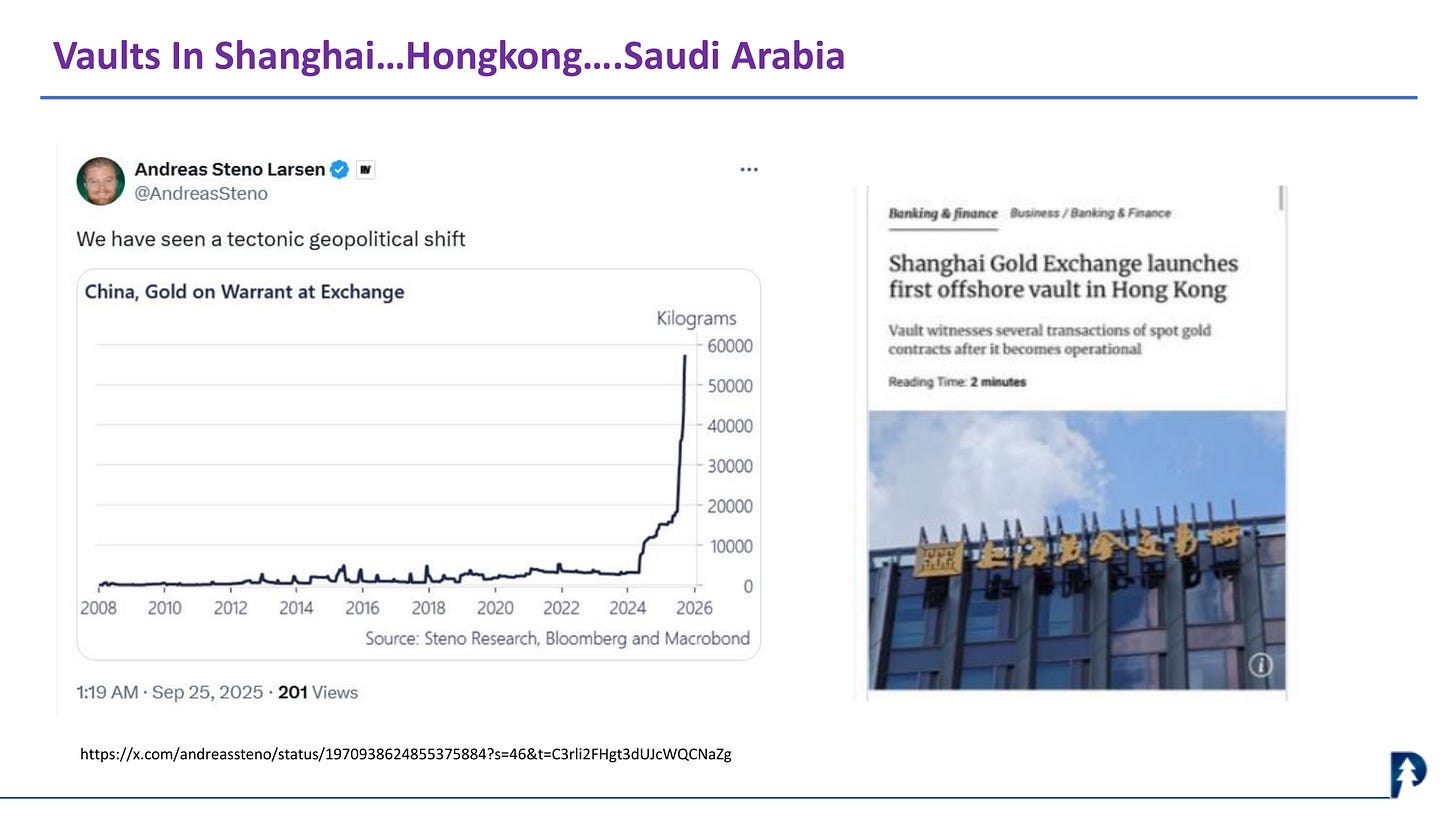

China appears to be preparing to settle net trade balances in gold, directly challenging the U.S. dollar’s reserve status, restoring gold as a neutral reserve asset, and laying the groundwork for an alternative to dollar hegemony.

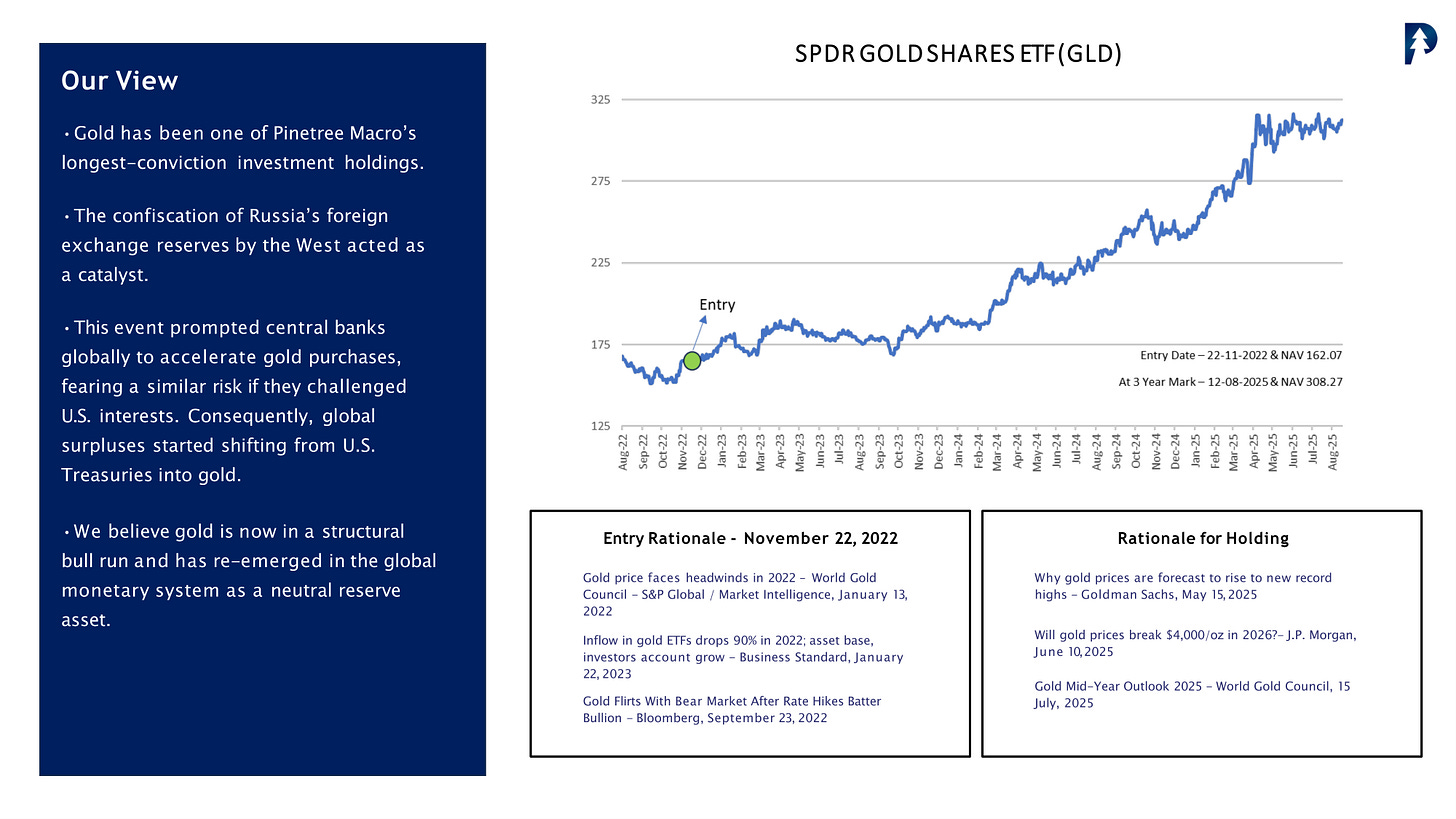

The GLD ETF, our chosen instrument for playing the gold theme, has been among Pinetree’s top holdings since the Fund’s inception.

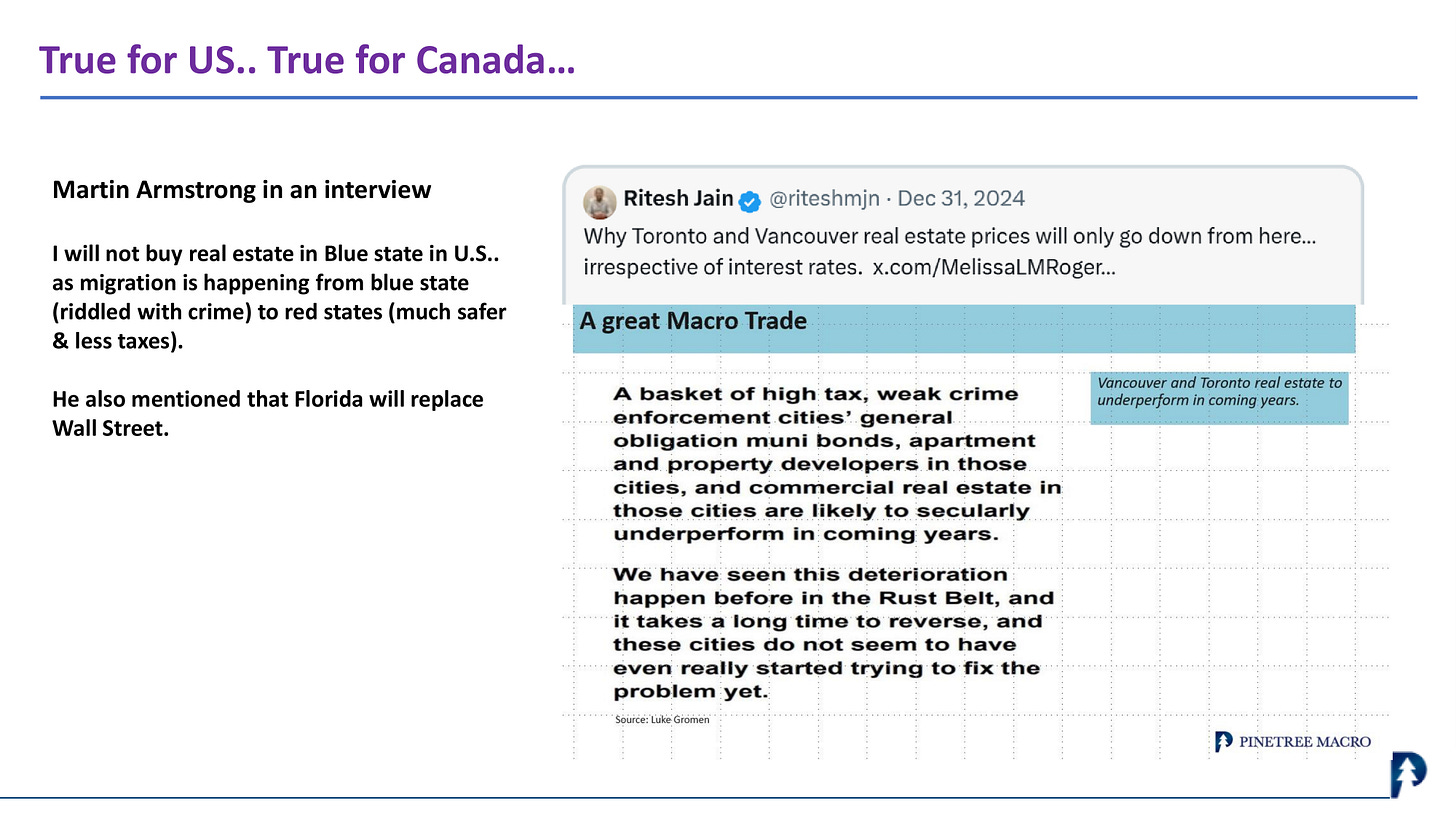

A lesson to remember not just for Real Estate:

In the AI race, power is becoming the biggest constraint, and the US has a lot of catching up to do.

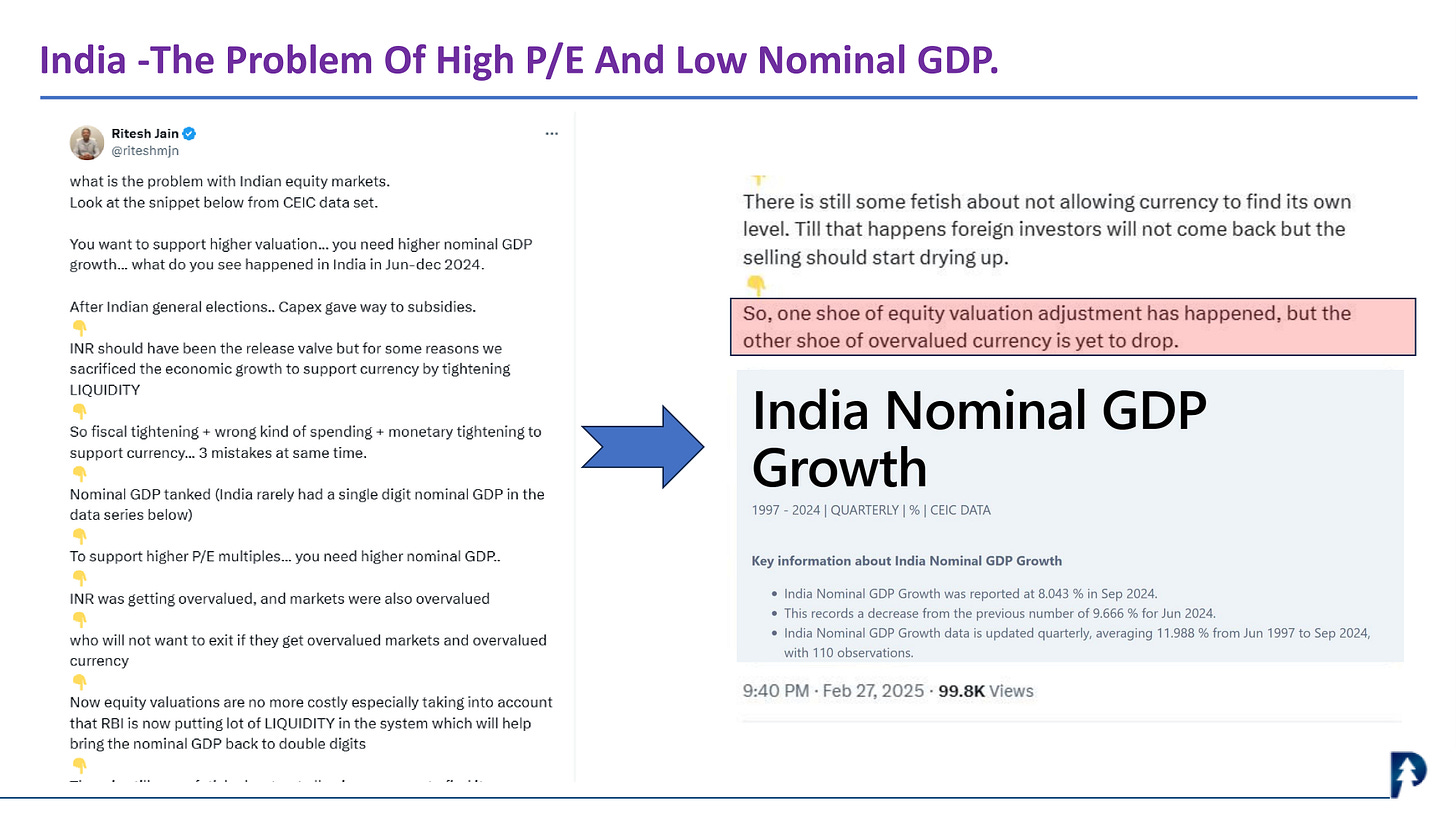

Indian markets have undergone both a time correction and a price correction, and we explain the reasons behind this below.

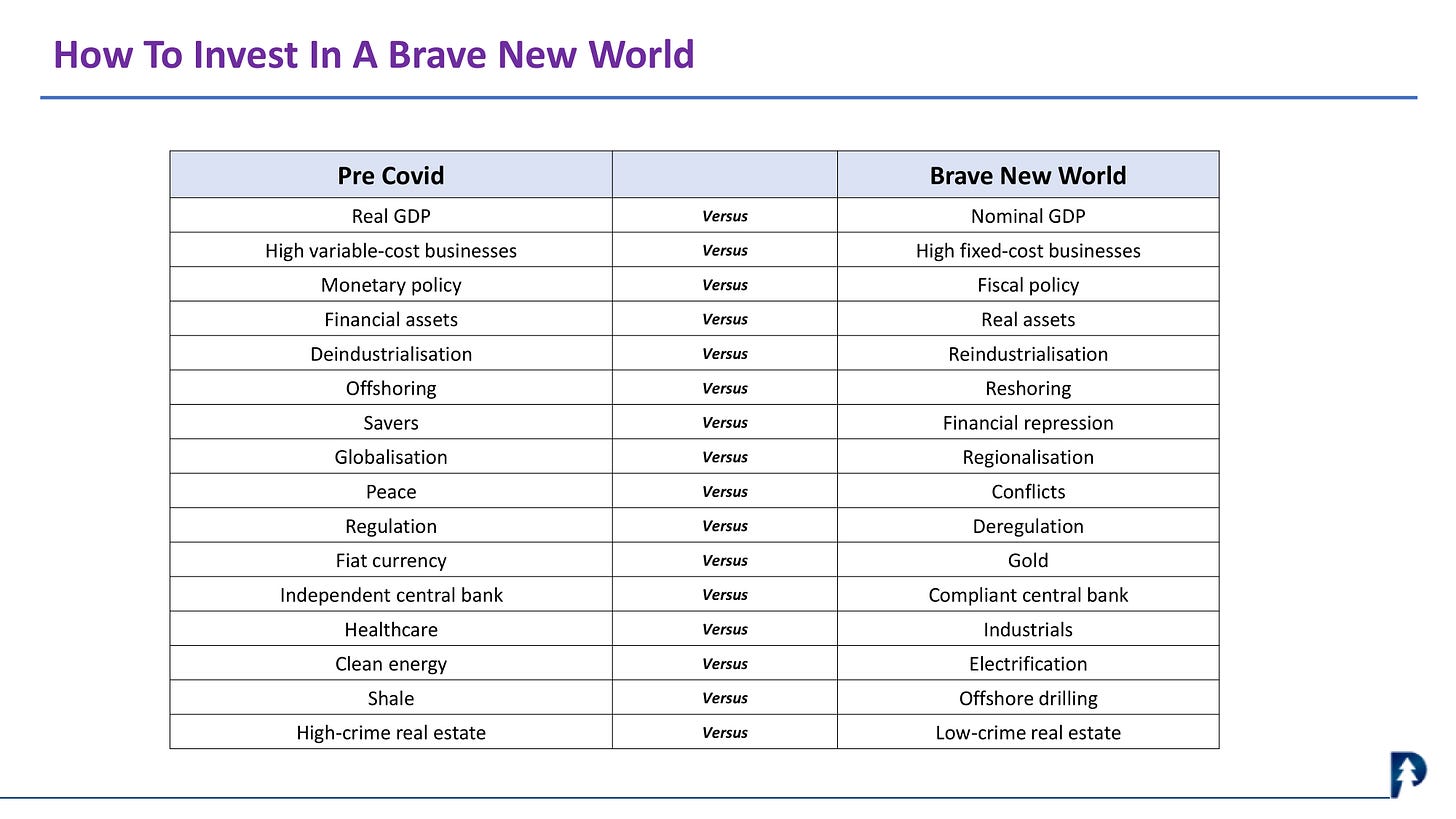

Post-COVID, we have entered a Brave New World where the investing framework has changed significantly. Below is a glimpse of what may work in this new environment.

With this final slide, we leave you with our thought process.

Check out the video below, which also includes a Q&A session that sheds light on some of today’s most pressing questions.