In the 1790s, there was a time when the U.S. federal government earned 100% of its revenue from tariffs. This was well before the United States Dollar assumed the role of the global reserve currency and long before America became a borrowing giant in international debt markets. Today, the scale of U.S. debt has grown so large that it is beginning to shake the foundations of a global economic structure that has remained stable for decades. The question now is: where are we headed, and what impact will this have on our investment portfolios?

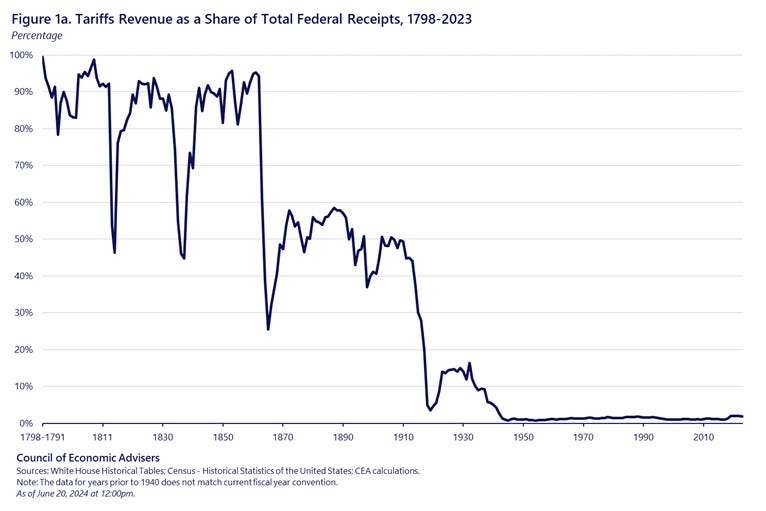

Fig 1. – Tariff income as a % of total federal revenue has diminished ever since the US economy opened to the world

Over the years, tariffs have steadily declined as a source of U.S. government revenue, replaced primarily by domestic taxes especially individual income taxes, which now contribute nearly half of federal income. This shift reflects a broader embrace of globalization, often viewed as a sign of a mature, open economy. However, this transition brings two major consequences.

First, as tariff revenue disappears, the financial burden shifts onto citizens through higher reliance on domestic taxation. Second, the theory of Ricardian equivalence of economics says to promote economic specialization and offshoring, which, while efficient in theory, often results in significant job losses and the erosion of domestic industries.

The U.S. faces an added challenge due to the dollar’s role as the global reserve currency. Constant international demand keeps the dollar overvalued, making American exports more expensive and imports cheaper. This dynamic encourages further offshoring, undermining domestic production and long-term job creation.

That leads to a critical question: how does the U.S. meet the world’s constant demand for dollars? The answer is through debt. The U.S. issues government bonds, borrowing from global investors to fund spending much of which supports domestic consumption. But here's the catch: that consumption is largely satisfied by foreign producers. So, the U.S. goes into debt to buy goods made abroad, leaving American manufacturers sidelined and trade deficits growing.

Debt, of course, must be repaid with interest. And it’s U.S. taxpayers, especially working Americans, who foot the bill. This dependence on domestic taxes to support foreign borrowing is a major concern for critics like President Trump, who question whether the system truly serves American interests.

The world benefits more from America’s borrowing than Americans do. The strong dollar enables global trade, foreign exporters thrive by selling to U.S. consumers, and international investors profit from U.S. bonds. Meanwhile, U.S. industries lose competitiveness, and American taxpayers absorb the cost. It’s a system that many view as unsustainable and one that’s now shaping Trump 2.0 policies, especially around overhauling the U.S. tax structure.

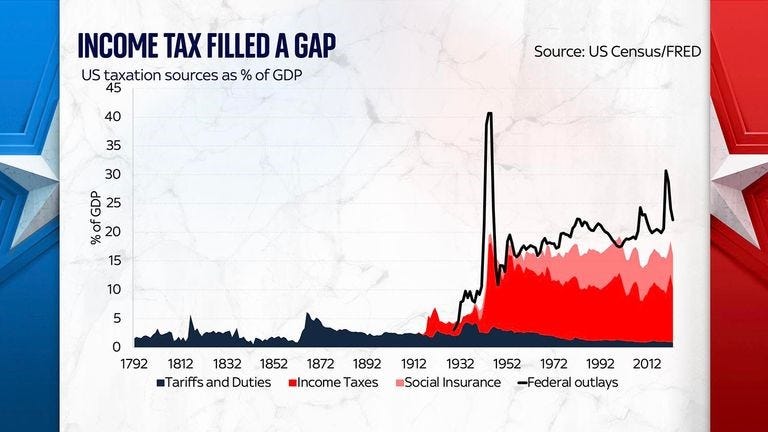

Fig 2. – Individual American income taxpayers carry the burden of US borrowing while the world enjoys US paper

President Trump aims to reverse a century-old trend by shifting federal revenue away from individual income taxes and back toward tariffs. His strategy is twofold: ease the tax burden on Americans and use tariffs to protect and revive U.S. industry. The logic is that shielding domestic producers from cheap imports could boost competitiveness, spur manufacturing, and bring back well-paying jobs. Over time, a stronger workforce could broaden the tax base and fortify the economy from within.

However, there’s a hard fiscal reality to consider. Even aggressive tariffs can't fully replace current income tax revenues. In FY2023, the U.S. imported about $3.12 trillion in goods. To generate the $2.6 trillion currently raised from individual income taxes, the government would need a blanket tariff of roughly 70% an economically impractical and politically explosive rate, especially since global trade patterns would inevitably shift in response.

However, a more moderate tariff say 10-15% could still be meaningful. While it wouldn’t fully replace income tax revenue, it could offset some of the tax burden for lower-income Americans. For example, the bottom 99% of U.S. taxpayers currently contribute about $1.43 trillion in direct income taxes, while the bottom 95% contribute around $884 billion. If President Trump aims to eliminate direct income taxes for Americans earning below $200,000, the question becomes: Can he recover $880–$900 billion through strategic tariffs without destabilizing trade?

It’s an ambitious goal but even a partial shift could reduce tax pressure on middle- and lower-income Americans while simultaneously boosting domestic industry. This could create a long-term investment thesis in the US consumption space.

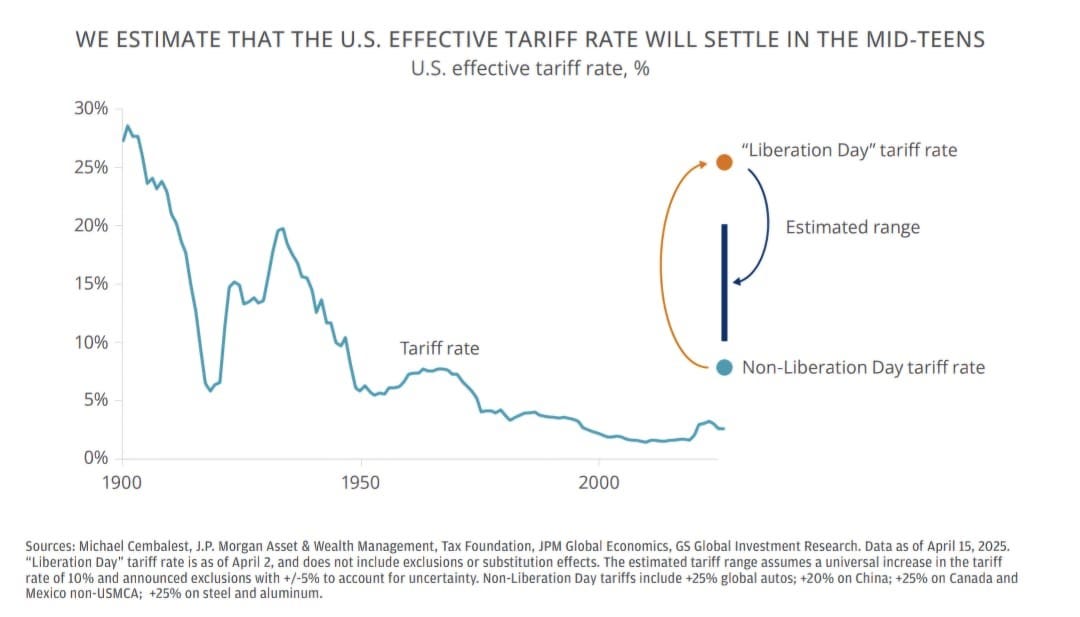

Fig 3. – Tariff income as a % of GDP has disappeared while income taxes and Social Insurance funded massive deficits

Source: Conway, E. (2025, January 22). Tariffs have a long history in the US - two charts tell that story. Sky News

Let’s have a look at the US imports –

Total imports by the United States were closes to $4.11 Trillion but 20% of total imports were in services which are not going to be tariffed, total goods imports were closed to $3.36 Trillion but that’s not all, President Trump has also exempted a lot of goods from tariffs which he considers to be of strategic importance for the United State’s journey of making itself great again, so we must exclude those earnings from tariff earning consideration.

Total Goods imports base

Figure 4. – Total Import Exemption to “Build America Great Again”

Source: Trump and the new tariffs of 2025: the list of exempted products – Export Planning. (2025, April 7).

Based on rough but reasonable estimates, it appears that President Trump may be planning to apply tariffs to roughly $2.21 trillion worth of imports. A 10% across-the-board tariff would generate around $221 billion in revenue. While that’s far short of the $880 billion needed to fully replace income taxes for Americans earning under $200,000, the picture changes when we factor in higher tariffs targeted at certain countries.

Fig 5. – The top 25% of population pays close to 90% of all US Federal income taxes, this mean President Trump could pull of a successful tax relief for the bottom 70-80% of the American tax paying population.

Source: USA Facts. (2024, August 1). Who pays the most income tax? USAFacts.

Nations like China and Vietnam are unlikely to face just the baseline 10% more likely, they could be hit with tariffs in the 20–30% range, effectively raising the weighted average tariff rate to around 15%. Under that assumption, tariff revenues could climb to approximately $330–$350 billion per year.

Fig 6. – Estimated stabilized Tariff rates

Source: : Michael Cembalest, J.P. Morgan Asset & Wealth Management, Tax Foundation, JPM Global Economics, GS Global Investment Research.

It would be inadequate to offset income taxes for the 95% of the population but it could allow for meaningful tax relief, especially for middle-income households. In other words, while tariffs alone won’t fully replace income tax revenue, they could be used strategically to shift some of the burden away from domestic taxpayers and onto foreign producers selling into the U.S. market.

Fig 7. – President Trumps tariff income has outpaced all the past couple of years, while the new tax bill announces income tax cuts. (Annualized at $ 249 Billion)

Source: https://bipartisanpolicy.org/explainer/tariff-tracker/

As per 2021 data, the top 25% of the US individual tax paying population covers close to 89.2% of total federal individual tax revenue, this means that the top 25% pays close to $2.32 Trillion in taxes and the bottom 75% pays only $ 280 Billion.

Fig 8. – Tariff earnings could finance tax reliefs upwards $ 300 Billion dollars making President Trump a working-class populist

In 2022, 153.8 million Americans filed their taxes with the IRS, that means if President Trump manages to implement this reform, we could witness close to 115 to 123 million Americans pay 0 individual taxes, this will unleash the spending capacity and money momentum in the US economy (This would also be inflationary along with all the other things the administration is doing).

We could expect Americans to spend more on consumer non-discretionary and consumer durables; this may also lead to more demand driven inflation which right now looks like President Trump will be able manage with lower energy prices and deregulation. Household savings are still healthy and this policy shift may add to that.

This will possibly increase consumption but eat away corporate margins.

Interestingly, this is the direction that the Trump administration is aiming to move towards.

Fig 9. – President Trump shared the WSJ article by Scott Bessent on Truth Social

President Trump’s big, beautiful bill also sheds some light into the taxation plans of the administration that seems very expansionary (something I would mind watching), I believe this extension of modified tax rate is a stop gap which will eventually change again once the tariff source of US federal income stabilizes –

Fig 10. – President Trump also plans to make his previous terms modified federal income tax rates to be permanent. We believe that this will be temporary and will again see modification once tariff revenues stabilize.

Fig 11. – President Trump also plans to extend the standard deduction benefits which were announced in his previous term

Some additional tax relief in the bill –

Fig 12. – Some more tax reliefs mentioned in The One, Big, Beautiful Bill.

Source: Title XI – Committee on Ways and Means. (n.d.). The one, big, beautiful bill: Subtitle A – Make American Families and Workers Thrive Again. In Title XI – Committee on Ways and Means.

Fig 13. – Ritesh Jain, Founder Pinetree Macro, connecting the dots of global macro policy shifts.

It is becoming extremely clear that big economies today are moving away from direct taxation to indirect taxation. India, one of the largest and strongest economies in the world started this revolution with the introduction of GST and exempted all individual income taxes for close to 85% of the income tax paying population, US is doing the same thing now and eventually the world may follow

What also seems quite clear is President Trump aims to create policies for the masses, and this also includes changes taxation policies.

Fig 14. – President Trump has also discussed ideas on offsetting lower income tax cuts by increasing top rate taxes of the rich.

President Trump, being a businessman at heart, may view tariffs not just as a trade policy tool but as a new revenue stream for the federal government. In this case, he may not eliminate individual income taxes entirely, but slightly reduce them, using tariff income to ease the burden on certain segments of taxpayers while maintaining overall revenue stability.

With another active revenue channel tariffs the U.S. could pursue a bold strategy of fiscal expansion aimed at driving nominal GDP growth. In many ways, this would make the U.S. economy behave more like an emerging market, aggressively spending to stimulate domestic production and employment.

But this approach comes with challenges of its own, that’s a topic of separate discussion.

Links –

Tariffs as a Major Revenue Source: Implications for Distribution and Growth | CEA | The White House

Tariffs have a long history in the US - two charts tell that story | Money News | Sky News

US Tariff Revenue as a Percent of Total Government Revenue Long Term Trend - SuperMoney

How did the Tax Cuts and Jobs Act change personal taxes? | Tax Policy Center